FAFSA Hints

FAFSA Hints and FAFSA Help for your 2024 FAFSA questions. Read our frequently asked FAFSA questions and answers, or see hints from other readers who survived the FAFSA in our FAFSA Tips and Hints from Students and Parents.

Last updated on March 23, 2025 by College Financial Aid Advice.

Common FAFSA Questions

Am I eligible for a Pell Grant?

Do I need my parents financial information to file my FAFSA?

My parents are divorced. Do I need both their financial information for the FAFSA?

Should I complete CSS Profile or FAFSA first?

I don’t have my tax information yet to file, should I wait to file my FAFSA?

How can I update my FAFSA with my final tax return information?

How will I know if any information is missing on my FAFSA?

What does the Asterisk * Mean on my FAFSA SAI?

FAFSA Questions and Answers

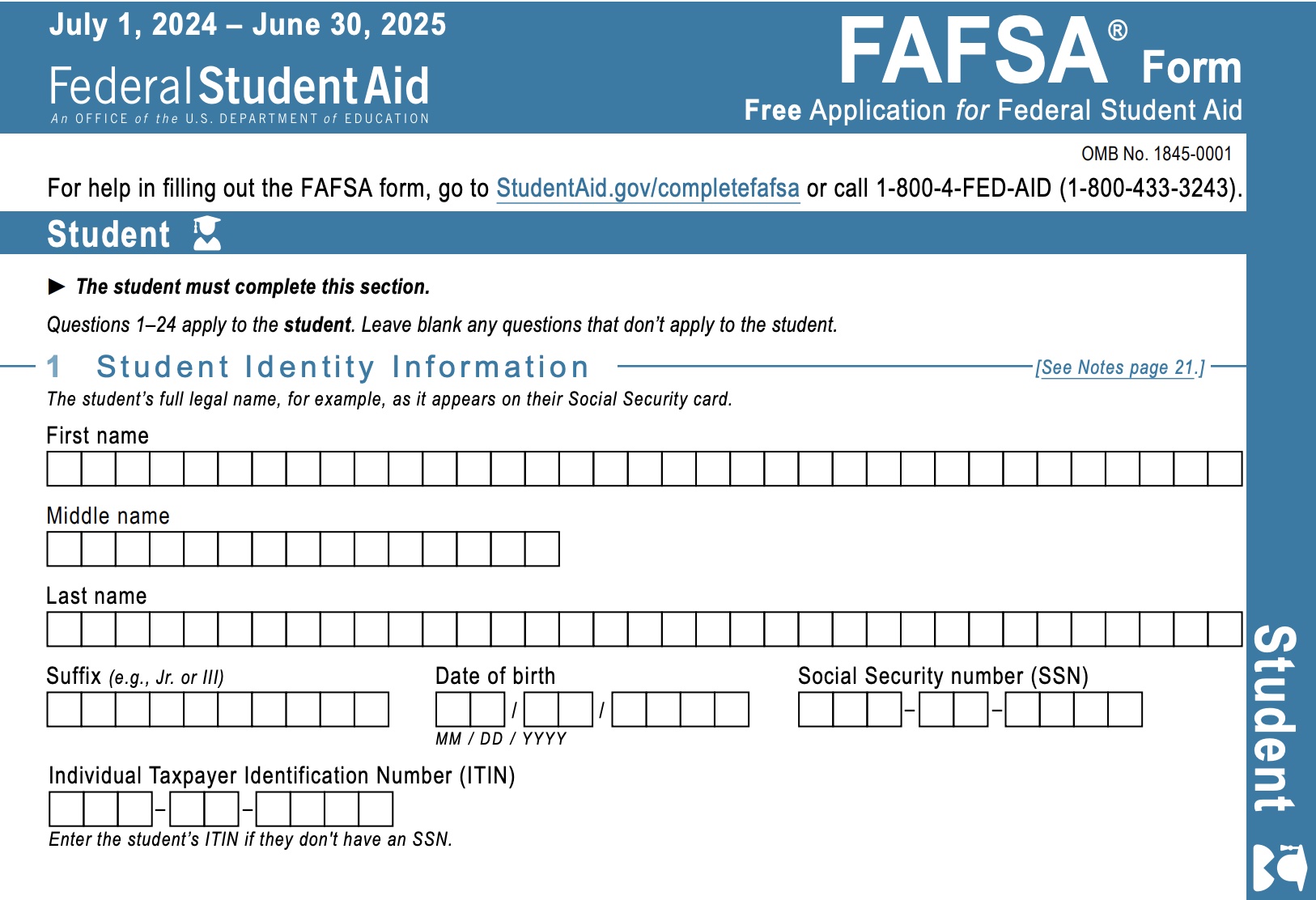

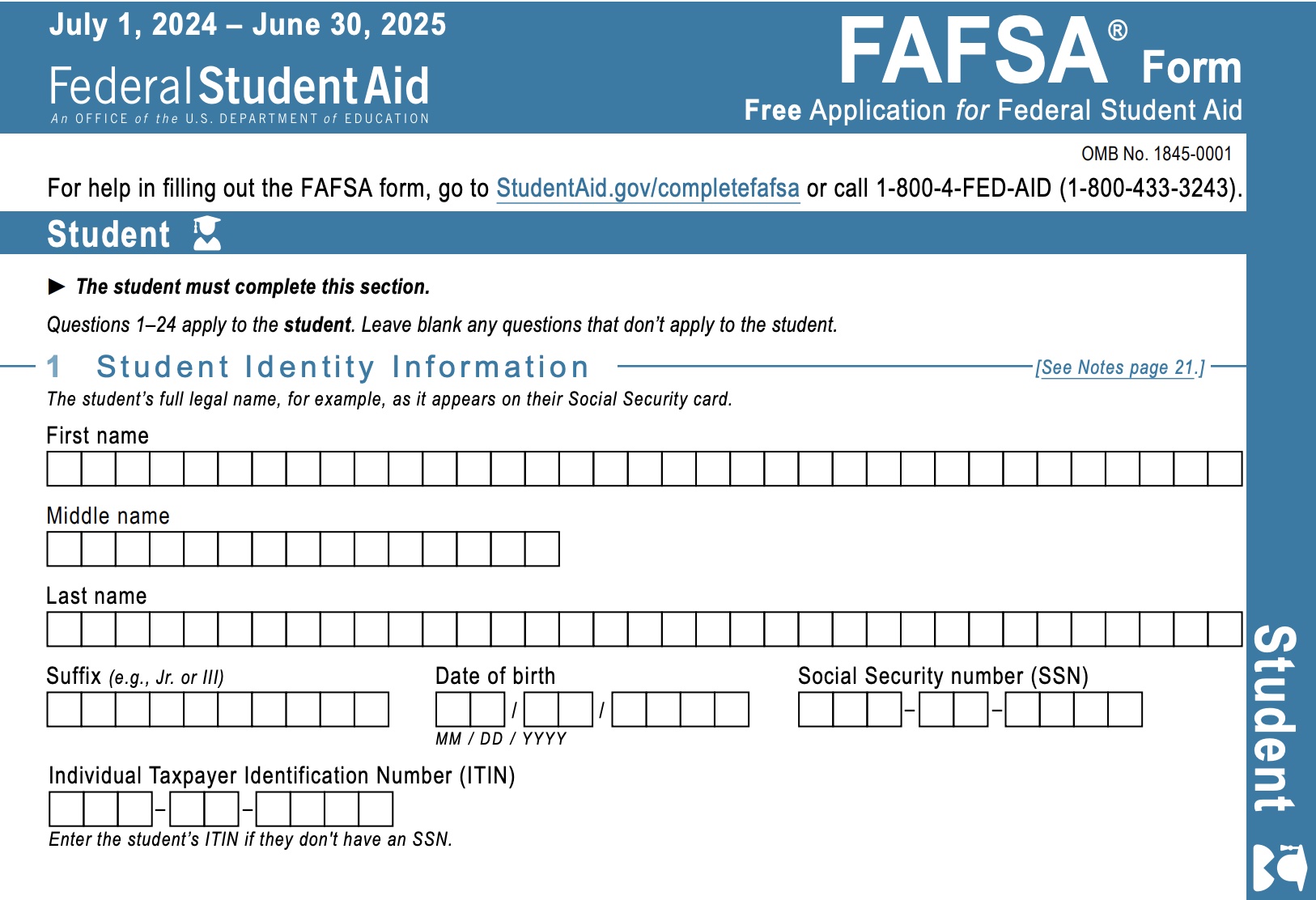

What is FAFSA?

FAFSA is Free Application for Federal Student Aid, the college financial aid application form that is used to apply for US federal grants, such as Pell Grants, and loans, such as Stafford loans. The application is also used for most state financial aid for college, and many scholarships.

CSS Profile is an additional college financial aid application used by many private colleges and universities to award scholarships and grants. If your school requires the CSS Profile, you must complete both the CSS Profile and FAFSA.

Am I eligible for a Pell Grant?

Most families with income of $40,000 per year or less and a low SAI will qualify for Pell Grant, but it depends on many factors. Your eligibility for a Pell Grant is determined based on the answers to the questions in your FAFSA.

Do I need my parents financial information to file my FAFSA?

If you are a dependent student (most unmarried students under age 24), then you will need your parents financial information to file your FAFSA. If they refuse, your federal financial aid may be limited to only unsubsidized federal student loans. For a complete list of the requirements for dependent or independent students, see Federal Student Financial Aid .

My parents are divorced. Do I need both their financial information for the FAFSA?

If your parents are divorced and you are a dependent student, then you will need the financial information from the parent you who provided the majority of your support, and their new spouse (your step-parent) if they remarried. If you don't currently live with either parent, then the parent who you did provide the majority of your support before you were out on your own. If you lived with both equally, then the one who contributed more to you financially during those 12 months. This may not be the same parent who claimed you as a dependent on their tax return. The rules for the CSS Profile are different, and unlike the FAFSA may require both parents financial information if they are divorced.

Should I complete the CSS Profile or FAFSA first?

If you need to submit both, it may be more efficient to submit the CSS Profile first. All FAFSA information is mostly a subset of the CSS Profile, and the CSS Profile gives you an option to transfer the information to your FAFSA.

I don’t have my tax information yet to file, should I wait to file my FAFSA?

Your FAFSA tax information will be from 2 years before, for example the 2024-25 FAFSA application will use your 2022 taxes. If you did not file, the form will verify that with the IRS.

How will I know if any information is missing on my FAFSA?

You will receive a FAFSA Submission Summary , (which replaced the Student Aid Report (SAR) in 1-4 weeks after submitting your FAFSA. The FAFSA Submission of Summary summarizes the data you submitted in your FAFSA, and alerts you if any data is missing. Submit the corrections or required information ASAP to avoid any delays.

What does the Asterisk * Mean on my FAFSA SAI?

The SAI on your FAFSA Submission Summary will have an * if your application was selected for verification. You will be asked to provide additional documentation to verify some of the information on your application.

FAFSA Hints from our Readers

See more FAFSA hints, contributed by our readers.

FAFSA Hints for Parents

Written by Nita from FloridaNo one told me eighteen years ago that I would need a training manual to begin the financial aid process to send my precious bundle of joy to college. After several ill-fated attempts to start this journey at the "log-in" page of the FAFSA website , I resorted to calling several 1-800 numbers! Thank goodness for patient tech support!

If I were to advise a newbie parent in this exciting process, I would encourage that they keep good records and keep them in one central location before ever beginning this process. I learned the hard way that I would need our family's tax documentation from the previous year, my son's social security number, his driver's license number, his username and password, which, unbeknownst to me he created himself at school. I later had to retrieve it from his guidance counselor, since HE didn't remember it! Gathering this information ahead of time would have saved me multiple stops and starts. This will definitely be an improvement I will make to my experience this coming year!

For those who may be facing job and income changes during this wavering economy, I have a bit of encouragement. After we filed the FAFSA Application in the early part of the year, I was laid off at work. Our family's annual income was drastically reduced. Thankfully, the college financial aid counselor had the wisdom to know that a FAFSA could be re-filed with more current income numbers. Although we ran things right up to the wire with date deadlines, our son received a much larger Pell Grant award , reflecting these changes.

My last encouragement is: Do not be scared to ask! The financial aid counselors deal with this stuff every single day! They know of scholarships and grants for your child . My "dumb" questions ended up saving my son several thousands of dollars that he will not have to pay back at the end of this college chapter. Make these staff members your new best friends. Treat them with respect and understanding, and they will return the favor!

Enjoy the ride!

Comment from your friendly team at College Financial Aid Advice

Thank you Nita for sharing your FAFSA hints for parents. I always encourage parents to be very involved in the process, because they have so much more experience in financial matters than the students. Check out our scholarship listings for more ideas for free money for college.

Filling out FAFSA with Tax Preparer

Help

FAFSA hints written by Clayton from Michigan

Having made a decision that I will be attending

college in the fall of 2022, I decided to take in some information at our high

school on exactly what FAFSA was.

Upon sitting in on this session at our school, I

was told that myself, the student, should be filling out the FAFSA application.

So, after the meeting adjourned and I was back at home I decided to sit down in

front of the computer and give it a try. WOW! I could fill out some of the

information that was needed, but after getting into the forms a bit more I was

really getting confused.

I am the oldest child in my family and so all of

this is new to myself and my parents. I suggest that you either have your

parents help you fill this out or even better, sit down with your tax preparer

and have him/her help out.

Having your tax preparer help with these forms

on-line is the option we chose. In choosing this option, I believe that this

was the best for us as our tax person gave us much advice, advice that I would

have gotten incorrect on the application. With this said, I was able to get a

$1400 Pell Grant which is wonderful. Please make

sure that you check the box that says you are willing to take part in work

study. This is for on-campus jobs like food services, etc. This will help in

your grant money if you are willing and able to do these studies during your

college years. I'm not saying that this will for surely get you a great dollar

amount of Pell Grant, but it is a help.

I will go back to my tax person next year as

well and the year after that or as long as I need to complete my college degree

for her to help me with the information that I am needed to provide.

Comment from your friendly team at College Financial Aid Advice

Thank you Clayton for sharing your experience in filling out the FAFSA. I agree that the application can be confusing, and that it is often easier for the parent to fill out the application if you are a dependent student. But you also have a good suggestion about filling out FAFSA with tax preparer help, since tax preparers are familiar with the financial information required. An accurate FAFSA can provide you a lot of financial aid for college so it is worth spending a little money if you need that help to get it done right. Good luck to you.

Special Circumstance Letters - FAFSA

FAFSA hints written by Tina from Southern CaliforniaNot everyone is a cut and dry W-2 holder with perfect credit and money saved up for their kid’s college. One rarely used tip is the Special Circumstances Forms that are available and can be found at most four year Universities. Once the FAFSA is filed, once the grants come in and you get your bill from the college, there is still more you can do. Fill out the Special Circumstances Form that the University has on their website or ask the financial aid office about it.

On the Special Circumstances form you can explain in detail about all of your expenses versus income and if there are any extra extenuating circumstances of how you are barely making ends meet and live on a check to check basis. On this form you can provide a detailed explanation of how you are receiving income on your tax return but can barely pay your bills due to high monthly payments you are making. These monthly expenditures can include payments for unpaid Federal taxes, mortgage cost, utilities, multiple car payments, food costs, credit card bills, property insurance, health care costs, property taxes, loans, and so much more. You can provide a detailed list and show them how little is actually left over and that there is barely enough for any extra college tuition payments. And don't forget about the multiple kids in college discount if it applies.

Most people are not the W-2 wage holders and perfect credit family. For those people who are self-employed and receive K-1 income, sometimes the number in Box 14 that the colleges ask for is not an accurate number. Sometimes this number (which is a combination of line 1 and line 4) is not the perfect picture of what dollars you are actually taking home. Some people who have business income do not actually take that income out each year. Many times, if it is a struggling business the money is just rolled back into the company. So you are being taxed on the income but not actually receiving it. Even this can be noted on the Special Circumstance Form, and trust me, every little bit helps. So if you are struggling and need just that little extra financial consideration, fill out the form – it can’t hurt.

FAFSA for Hispanic Parents

FAFSA hints for first generation parents by Angelica from North Carolina

Trying to Explain the FAFSA to Hispanic Parents - Well finally my senior year is here. So many things to do and so little time to get everything done. When I first started my senior year, it was all about graduation project or prom, but what I always had in the back of my head was the FAFSA.

I'm a first generation to go to college, so my

parents were not prepared to go through all the application processes of

colleges/ universities, paying for many applications, or did not even know what

the FAFSA was really for. I had to explain

and take it step by step and try to be patient with my parents and myself.

Being part of the Hispanic culture and going

through the college phase is very stressing, especially for the first

generation students. Towards the beginning of the year I would pop up the FAFSA

conversation, so my parents could have a vivid imagine about what was about to

happen.

When I first told the about the FAFSA my parents

were very confused and started asking me a lot of questions about it. My

parents are not very well at speaking English, but they can understand some of

the English language. Whereas I have difficulty translating English into

Spanish, so when I trying to explain in English and saw that my parents were

having difficulty understanding; it was hard for me to put what I had just said

in Spanish. I always had to try my best when trying to explain the FAFSA to my

parents, so they could understand it to the fullest.

Every time we had a meeting with our school

counselor I would grab as much information I could to tell my parents about the

FAFSA. Most times the school counselors went into our classrooms they would

show us a PowerPoint presentations about the FAFSA and then when I went back home I

would re-teach my parents what I learned about the FAFSA with my school

counselors. My parents began to understand the FAFSA process and I felt pretty

good.

Every time I had the time, I would go online and

research more information about the FAFSA. Many say that the FAFSA is a long

process and that it takes too long to file, but what I saw was that if you all

have all the information needed, the process will go out smoothly.

It’s better to do the FAFSA with both of your

parents, so if you have any questions they will be right there to help. Doing

things about college like filling college applications, researching and

applying for scholarships is better to do it with both parents are around.

Parents give you moral support and you feel that they really care about you and

your education.

Since I am a first generation, I feel my parents

more stressed out then ever before, I try telling them that everything will be

fine and that we will get through this as a family. My parents worry the most

about the financial part of the college career. The FAFSA will help everyone

even if it’s just by a little, but I encourage everyone to apply for the FAFSA.

Each year every student has to apply for

the FAFSA again because they could give

you more money or make changes in the money you are getting. The FAFSA could

either be in the form of a grant or a loan. So, while I was explaining this to

my parents I was pretty sure they were going to have a question about that. I

told them that a grant is free money and that it didn't needed to be paid back

and that a loan was like getting a house, you get money from the bank and then

pay it back years later. My parents understood what loan was so, when I first

told them they were like not getting a loan. I agreed with that because I did

not want to finish my college years and still be paying off my schooling years

later.

The FAFSA was not easy for my family to

understand, but after the applying is done, it so worth it. Once you have

finished applying its time to wait a few weeks for the information to process.

Then you will be

receiving

information though email and mail telling you about the qualifications you meet

and the money you are awarded. If you do not want to accept an award the best

thing for you to do is call the Financial Aid Office and tell them you are not

interested in that award.

This was for many of the Hispanic parents that

are not so sure on what to expect on the FAFSA, ask your children for more

information about the FAFSA if you do not understand, because by asking "

What is the FAFSA?" could change the college career of your child. Plus,

the FAFSA gives away free money to help you, the parent or guardian out for

your child’s education.

Comment from your friendly team at College

Financial Aid Advice

Thank you Angelica for some very good advice for

FAFSA for Hispanic parents. You might also use the Spanish version of the FAFSA

to help communicate to your parents who don’t speak English well. You can also

submit your FAFSA using the Spanish version if you prefer. We have links to all

the key FAFSA information and tools at FAFSA Official Website.html.

Check out our more FAFSA tips on financial aid

for college, and our page on Hispanic Scholarships . Good luck.

Child of Undocumented Immigrants?

Not all hope is lost.

(by Anonymous, Miami, Florida)

When my parents told me I'd have to wait a

couple of years to go to college because I couldn't apply for financial aid, I rebelled. I

wouldn't give in to this, so I had to find a way to help my situation. But

first, I guess I have to tell you what my situation was.

My parents are both undocumented immigrants.

However, I was born here in the United States, so I am a US citizen. That means

that technically I am allowed to apply for aid from FAFSA, but doing it was quite difficult

because my parents can't file income taxes. You should probably know that

undocumented immigrants are actually suppose to file taxes if their incomes

require them to. Having that said, if they get audited by the IRS, they will

probably be deported because they don't have a valid ID to enter the IRS office

with and their situation will become known. This is the reason why my parents

don't file.

But notice that I said that undocumented

immigrants only have to file "if their incomes require them to." My

parents are divorced and I live with my dad. That means that he is the head of

the household. For single-parent families, the minimum income that requires you

to file taxes is about $12,500 (the number varies slightly each year, so make

sure to check). His income is $12,000. Therefore, I was able to apply for

financial aid through FAFSA without a hitch because my dad was not evading filing

taxes since he wasn't even required to file.

So my advice to all you children of illegal

immigrants is to check whether or not your parents' (or parent's, if you live

with a single parent) income requires them to file taxes. If not, then you are

safe and okay to fill the FAFSA out.

Comment from your friendly team at College

Financial Aid Advice

Thanks for sharing about how a child of

undocumented immigrants can be eligible for financial aid for college. If the

child is a US citizen, he/she is eligible to submit the FAFSA application for

financial aid for college. This requires a valid social security number for the

student. If the parent who the child lives with does not have a social security

number, the student can still file a FAFSA online and the parent can just sign

a printed form. For more information, see FAFSA Application PIN Number. Best of luck to you and other children of

undocumented immigrants.

More FAFSA Information

Dependent or Independent Student

Welcome!

Welcome to College Financial Aid Advice, a website full of information on scholarships and grants, student loans, and other ways to save money at college.

Important Things to Do

Scholarships for 2025 - 2026 - It is never too early or too late to work on your scholarship searches. If you are part of the high school class of 2025, you should work on your scholarship and college search now. See our list of Scholarships for High School Seniors

FAFSA - The official 2025 - 2026 FAFSA is available now. FAFSA.

College Financial Aid Tips

Scholarship Lists An overview of the different types of Scholarship Money for College.

Grants Learn more about grants, the other free money for college.

Need Tuition Help? Reduce the cost of tuition with these college Tuition Assistance Programs.

Tax Credit Claim the American Opportunity Tax Credit.

College Savings Plans Save money for college with these College Savings Plans.

Need a Student Loan? Yes, you qualify for these college Student Loans.

Popular Scholarship Searches

Scholarships for High School Students