Community College, State University, or Private University? You Decide

Should you attend a community college, state university, or private university? You decide based upon what makes sense for you.

Last updated on March 23, 2025 by College Financial Aid Advice.

It is interesting that we received quite a few emails from students who chose the community college option, and were very happy with their choice. In fact, the letters that we received from people who were unhappy with their choices, were mostly from people who racked up a lot of student loans. So read more about the choices that prospective college students have to make: community college, state university, or private university? You decide what is best for you.

Save Money and Gain Experience with

Community College

(Staphany, Texas)

My senior year of high school I was really focused on attending either a private or public 4 year university. All throughout high school, these were honestly the only options I considered and had been exposed to and encouraged to go to. Although I only applied to one in-state public 4 year and one out-of-state private 4 year institution, I recommend you apply to several just to have options.

As the title of this essay will tell you, I

ended up not going to either one. Instead I made the tough decision to stay in

my hometown and attend community college to avoid accruing high student debt. I

can honestly tell you that was one of the best decisions I’ve made.

I had a great experience at a community college

for a fraction of the price. I qualified for Federal Pell Grants and was able to cover my entire

cost of tuition and textbooks. Not having the added financial stress enabled me

to take my mind off tuition and focus on my courses, extracurricular

activities, and an internship.

These experiences allowed me to gain a better

understanding of what I wanted to do in my academic and professional career.

Ultimately, my internship introduced me to a new job field and led me to find a

different 4 year private college that more closely matched me and provided me

with the scholarship money to fund my education.

So please consider attending your local community

college to both save on tuition and gain experiences to better prepare you for

attending a 4 year institution. You can also use those two years to make

additional money through work-study, jobs, or scholarships to pay for the

remainder of your college career. In a smaller setting, take the opportunity to

make relationships with your professors and faculty who can also inform you

about potential job, internship, or scholarship possibilities as well.

Use What You Got

(Nikki, Iowa)

Community college option - When I graduated from high school, the last thing I wanted to do was attend a two year community college. Everybody knows all the cool people go to four year colleges after high school—and let me tell you, I was the cool kid! However, after seeing how much older sister was struggling with her grades I reconsidered my options and decided to stay at home for one more year and go to the local community college.

I highly suggest to anyone who is thinking about

going to college to get as much college credit in high school. I was very

fortunate because my high school offered numerous college level courses; and,

as a result, I only had to stay at home one more year rather than two (I

completed an entire year of college liberal arts classes for free from my high

school).

After that year, I transferred to a four year

university and completed my bachelors in only two additional years. This means

I had graduated from college one year before my peers and with a much better

GPA than most of them. Because I had attended my community college, the classes

were easier to get through in a much more relaxed environment than what I

experienced at my four year university.

Finally, now that I am paying back my student

loans, I am very proud of what I did to save my money. I graduated with a

bachelor’s degree (the same as my older sister) with half as much debt as her

(a difference of $20,000). I also graduated with a better GPA than her, which

is beneficial especially for people who want to continue their education

further.

Looking back on it now, I feel like a community

college is an option every student should consider. I graduated from my

community college with people I never would have met if I went straight to my

four year and with memories that will last a life time. I believe that it

is not where you go that matters, but who you meet along the way.

Community College, State University, or Private University? You Decide

by Ashley from North Carolina

I began my college search very early into my junior year of high school. I had always believed that I would and could go to a four year university. Guidance counselors and other people I knew who had been to college suggested attending a community college for a couple of years before transferring to a four year university to finish my degree. I had always shrugged off the idea, thinking that I would go with what most high school students would; go straight into a four year college. While talking with my guidance counselor of three years, she told me to seriously look into a community college for two years. Again, I shrugged off the idea. I began asking around. At work, several of my coworkers had attended community college for two years and then transferred. One coworker told me that she was glad she did hers that way.

I never began

seriously considering community college until I began looking at college costs.

I was currently stuck between three different schools. I wanted to attend Elon

University, because I had done an internship there this past summer, the campus

was beautiful, and I knew they had the degree I wanted to go for. I also wanted

to attend North Carolina State University; my dad had graduated from NC State

and I have always wanted to go to State. This was when I added a third school

to my list, Alamance Community College. Several of my classmates have taken

classes there, and several of my coworkers have gone or are going here.

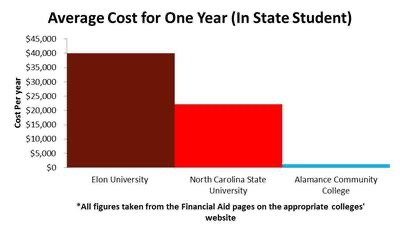

The chart shows the average cost for one year at

the three colleges I was debating between. As you can see, Elon, the private

university, has the highest cost. NC State is towards the middle of this range.

However, at the end, Alamance Community College has the lowest cost per year. I

knew this was an important decision to make as a high school senior. After much

consideration, I decided that I would take two years of classes at Alamance

Community College to hopefully take most, if not all, of my general education

classes, and then transfer to NC State to finish the degree I wish to have

(bachelor’s in computer science). In making this decision, I had to take into

account several factors. If I attended a four year university to begin with, I

would not be able to live at home, and, unlike most teenagers today, I like

home! By attending Alamance Community College, I would be able to live at home

for a while before venturing out on my own. In addition, I work a part time job

at a restaurant as a waitress and hostess. If I attended a four year

university, I would have to leave my job and would have no source of income. I

would soon become the stereotypical broke college student! By living at home

and attending Alamance Community College, I can work for two more years before

leaving home, saving up every penny of it. The main reason I chose to attend

Alamance Community College is because it was cheaper. General education, if the

credits are transferable, can be taken at any college across North Carolina. I

took it into perspective when I was posed with this question, “Why do classes

for $20,000 plus when you can take them for $2000 at home?” This made me

realize that Alamance Community College would be the way to go for me.

I was very skeptical about attending a community college at first. I hear all of my friends and classmates talking about how they’re going to go to a big university for four years. Me, on the other hand, am going to stay close to home for a bit, knowing that the path I chose was the right one for me.

Comment

from your friendly team at College Financial Aid Advice

Thank you Ashley for sharing your story Community

College, State University, or Private University? You Decide.

Community college is very cost effective, especially if there is a good school

near your home that offers many classes that will transfer. The fact that you

already have a job is a plus too, as sometimes it is hard to find a new one at

a 4-year university as many students are competing for those student jobs.

Many of your friends who attend a 4-year university right away will be in debt with student loans. A few will be lucky to have scholarships and grants that pay a majority of the cost, but most will not. Community college allows you to save money and of course students should always submit a FAFSA or Free Application for Federal Student Aid to apply for financial aid for college, including scholarships, grants, work-study and federal loans.

Good luck to you.

Making the Most of High School AP and Dual Credit Classes to Save Money

(Joe, Pennsylvania)

Scholarships. Financial aid. Essay contests. These

are all credible ways to help defray the cost of a college education, but there

is another way that may be even more efficient and effective if you're a hard

worker and don't mind a little academic challenge. Take AP and dual enrollment courses while in high school. This is money in the bank for students who can do well in

their classes. It is also a great strategy for students who don't qualify for

any special need-based aid.

By planning ahead and working with teachers and

guidance counselors, students can take advanced placement (AP) classes in areas

they excel in at high school. If you pass your AP exams with good scores

(usually a 3 or higher depending on the

Dual-enrollment, which means you take a high

school class that is taught on a college level and you receive credit from the

local community college if all requirements are met, is another great way to

earn college credit while you're still in high school. Complete another college course or two over the summers of

your junior and senior year, and you may have almost a year or more of college

credit complete before you graduate high school. This can save thousands of

dollars! You can save time and money getting some of the general college

classes out of the way, and save on room, board and books if you have enough

credit to reduce your stay a semester or two on campus.

In addition to saving money, this strategy of

taking AP and dual enrollment classes during high school has another benefit.

You get the opportunity to see what type of work is required at the college

level so you can learn how to manage your time and resources better. Managing

these skills, critical for college readiness and success, will be crucial that

first year away from home.

Is it a little harder to take AP and dual

enrollment? Absolutely. These classes generally move at a faster pace than

regular academic classes, and they require more time and effort. You may have

to say no to friends once in a while when you're on deadline and have work due,

but in the long run, it's worth it.

If you want to find another way to help reduce the

financial cost of a college education, consider taking AP and dual-enrollment

classes at your high school. You'll work a little harder, but this strategy can

really pay off.

What Your Parents Don't Have the Heart to Tell You

Being accepted to college is probably one of the greatest feelings, knowing that you’ve accomplished something so memorable. Being accepted to your ‘number one’ college is probably the next greatest feeling, knowing that you’ve reached your goals.

Hopefully you have supportive parents that are

willing to let you decide where you truly want to attend college. My parents

were always there for me, telling me that ultimately it was my decision to go

where I wanted to. Ever since I had visited campus the very first time, I knew,

without a doubt, that I was going to attend Roger Williams University.

After being accepted, I knew that my heart was

already set to go there, but I had to weigh the consequences. Since I am a

marine biology major, not many schools in the New England area provide that as

a major, so my selection was slightly limited. Another school that was under my

serious consideration cost just as much as Roger Williams, so other factors

determined my decision between the two. However, tuition here at RWU is

approximately $46,000, not exactly pocket change for someone from an average middle

class family. Although I had done exceptionally well in high school, and had

received a decent merit scholarship as a result, the remaining balance was

still a scary, large number. I knew that there was no other school I wanted to

attend, based on how much I loved it here and their marine biology program.

Ultimately, I did decide to attend RWU and my parents stood behind my choice.

Although my parents always supported me, during

the decision process, they also played the devil’s advocate. They would present

the idea of how am I going to pay for four years of tuition, which is

approximately $190,000, or close to the cost of a small house. I knew they were

willing to pay for as much of the total cost as possible, but chances are good

that I’ll still be paying those bills by the time they die. I told them, and

myself, that I wasn’t concerned about the cost because I was going to be doing

what I loved in life as a career. Also, I knew deep down inside that my heart

was set on attending Roger Williams and I didn’t want to hear anything else. I

think I also convinced myself, somehow, that it really wasn’t that expensive.

Little

did I know that once I reached college and got to see the Bursar bills and loan

payments, I would soon regret choosing to go to such an expensive school.

Knowing that I truly am on my own from here on out, pretty much, the thought of

such owing a tremendous amount of money scared me. I tried for the longest time

to attempt to justify this to myself by saying that it wouldn’t have mattered

because any other schools with marine biology programs were just as expensive.

First semester of school I’m pretty sure I

thought about transferring almost everyday, with the cost being the main factor

of my thoughts. I know now that I’m happy here at RWU, and although I have no

intentions of transferring anymore, I probably should have chosen to go

somewhere more affordable. Knowing that my parents have yet another monthly

bill they have to pay for me breaks my heart because I know I’m responsible. I

do understand some people may not feel this way, but my parents and I are very

close so things like that bother me.

So all in all, you may think you know that your

parents will always support you, but deep down inside they might wish you make

a different choice when it comes to college. I can honestly say that I do not

believe that my parents had the heart to tell me not to attend Roger Williams;

yes, they may have obviously shown me very good reasons why I should go

somewhere else, but they never directly said no, because ultimately it was my

decision. Regret isn’t a word that I use often, but when it comes to the cost of

attendance here I absolutely regret not going to a school that is more

affordable.

My advice to those deciding on a college

and are concerned about it from a financial standpoint: make sure that you

consider all aspects. Mainly, make sure you understand just how much it’s going

to cost you, your parents, or both. Obviously make

sure that the school offers the program you are looking for, and be sure that

you feel like you belong at that school. Picking which colleges to apply to is

the easy part, picking which college you want to attend is what needs the most

consideration.

Get It While It's Hot

(by Sache', North Carolina)

Most people think about going to a four year

university when they are in high school, not realizing that that might not be

the best choice. In my opinion, it isn't even a smart choice. Going to a

community college for two years then going to a university is the most logical

choice. Community college is cheater and gives you the opportunity to find

yourself before spending a ton of money because you decided to switch your

major 3 times. It also is a lot more cost efficient too.

I was home schooled for 3 years and my family

didn't know about how to pick colleges. The one thing I did know was that I

wanted to do something that dealt with art and that I needed to go to a two

year before I went to a bigger school. I am so thankful that I chose this path.

Since then I have changed my major twice and it didn't cost me a penny.

Most semesters I get money back because my

financial aid covers tuition. Depending on the college that you go to, you

could get a thousand dollars or more back after fees. What better way to save

up for a car, pay off some bills, pay for college related activities, and take

on extra courses to finish early. Even the cost of living is cheaper. Dorms

could be fully paid for or if you live with parents, just pocket the money for

later use.

Think of all the possibilities. If you get a job

while in school as well you could save that money, save the grant money, and

get scholarships on the side. You could even get your full grant amount back!

In less than a year, you could pay back any loans you may have from previous

schools, pay for a car, and save up money for your stay at a four year. All of

this done without the stress of extremely hard university classes.

Community

college not only allows you to save money, you can join clubs and

organizations. Most or all are free at two years, while at universities you

probably have to pay a small or big fee. Some of these clubs and programs have

wonderful activities like studying abroad. Bigger institutions have this

program but at a two year college it will cost less and will be much shorter.

Since it's a lot cheaper it will be easier to find a scholarship towards it.

You could even use that money saved from grants and work to pay for it!

If you decide you want to go to a university

first, I urge you to go to a small one first. When you are young, you need to

get use to college and all of your choices. Most of the time you won't even

know what you want to do. You could always transfer to a four year and have two

years of the degree already out of the way. By then, you will know what you

want and a lot of the choices you might have.

Comment from your friendly team at College

Financial Aid Advice

Thank you Sache' for sharing your advice about

the benefits of a community college. I think this is a great way to go for many

students, and you’ve certainly summarized many of the benefits. I would add

that there are some excellent teachers at community colleges too. Best of luck

to you.

Paying for your kids college and

setting them up for the big move when they graduate!

(Lourdes, New Jersey)

One of the great tips that I suggest parents

seek out for college tuition is first making a decision to look at in state

colleges and universities for their child. This process should begin as early

as ninth grade and no later than December of junior year. Visiting colleges

early allows for you and your child to get the feel and experience college.

Our daughter attending a state

college/university has allowed my husband and me to pay for my daughter's

college through a payment plan and a minimal loan each year. Also, living at

home and leasing a car at the rate of $9,000 for 3 years as oppose to $14,000

or more for room board and meals. This plan is set up so that our daughter can

graduate with her undergraduate degree and complete her Master's degree within

a five-year period with loans no more than $25,000 to $30,000.

The goal here is so that when she graduates she

can move out on her own and purchase a home of her own and then take out a home

loan that will be an investment. The money that she will save on student loans

will be beneficial in being able to afford to live on her own when she

graduates.

Paying off her loan at the rate of $420.00 a

month for 6 years will be the goal. This will allow her to be student loan debt

free 6 years after graduating college having her bachelor and master degrees.

Student loan

forgiveness is a great idea, but this plan does not work for every major/career

track. A student loan is an investment into the future it should NOT be a

financial death sentence, which many of the young people going to college today

are faced with! The goal of a college education is to be marketable in the

career path that one chooses not a death trap in the system of loans.

The first step in the financial process is to

complete the Free Financial Aid Free Application form

online and submit all the financial documentation that is required to be

considered for grants, loans and scholarships. The omission of this application

will delay and disqualify you and your child for money for college. As parents

we must advocate and manage our children’s future goals and dreams and

diligently seek out funds to offset the cost of college. From one parent to

another, let’s continue to encourage greatness in our children!

Save on College Tuition in High School

(Kyle, Florida)

There are countless ways in which students can save money for college. One of the most efficient ways to do so is by taking AP or IB classes. These classes are free to the student since they are taken at their regular high school. Taking these classes and passing the exams will give the student college credit. The average tuition per credit hour can be anywhere from $175 - $300. Most college classes are 3 credit hours. We will say tuition will be $200 per credit hour to keep things simple. If a student takes a total of 4 AP/IB classes in high school, then this student saved $2400.

My own personal example, I received a total of

36 credit hours for my AP classes taken in high school, saving my family and I

$21,600. Not bad savings and I got many prerequisites out of the way when I

came into college, saving even more money on living expenses.

AP/IB classes are by far one of the easiest ways

to save money for college, not to mention the additional challenge will prepare

high school students for college classes.

More College Tuition Tips

Read more stories and information about the big decision of Community College, State University, or Private University. You decide what is best for you.

Welcome!

Welcome to College Financial Aid Advice, a website full of information on scholarships and grants, student loans, and other ways to save money at college.

Important Things to Do

Scholarships for 2025 - 2026 - It is never too early or too late to work on your scholarship searches. If you are part of the high school class of 2025, you should work on your scholarship and college search now. See our list of Scholarships for High School Seniors

FAFSA - The official 2025 - 2026 FAFSA is available now. FAFSA.

College Financial Aid Tips

Scholarship Lists An overview of the different types of Scholarship Money for College.

Grants Learn more about grants, the other free money for college.

Need Tuition Help? Reduce the cost of tuition with these college Tuition Assistance Programs.

Tax Credit Claim the American Opportunity Tax Credit.

College Savings Plans Save money for college with these College Savings Plans.

Need a Student Loan? Yes, you qualify for these college Student Loans.

Popular Scholarship Searches

Scholarships for High School Students