FAFSA

Free Application for Federal Student Aid

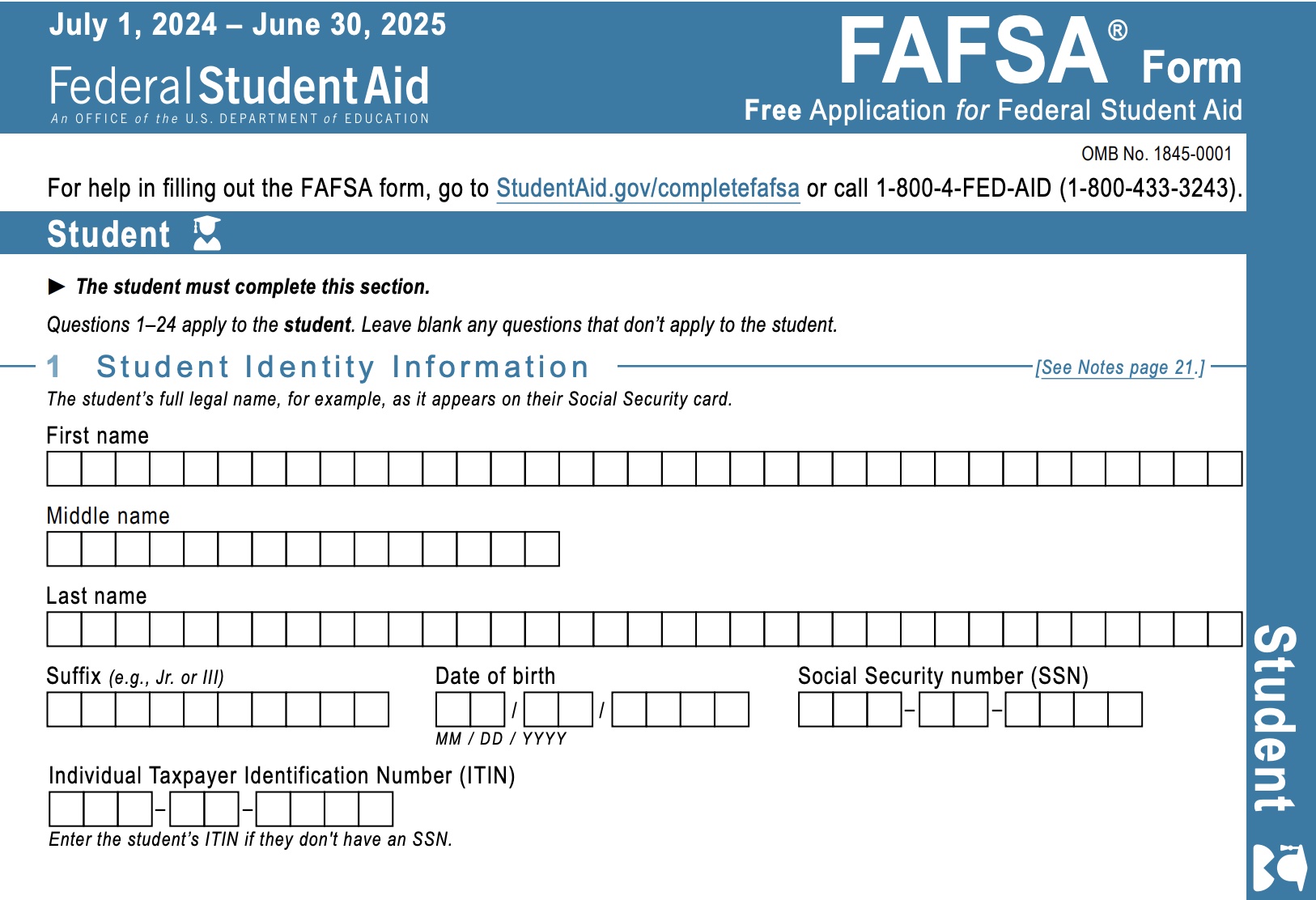

FAFSA stands for Free Application for Federal Student Aid - your federal student loan application to apply for college student grants and loans. This will determine your Student Aid Index, or SAI, which is an estimate of your eligibility for college federal financial aid.

Last updated on January 17, 2025 by College Financial Aid Advice.

FAFSA 2024 - 2025 Apply

The official 2024 - 2025 FAFSA application is now available, and can be used for fall 2024, spring 2025 and summer 2025 (7/1/24 - 6/30/25).

FAFSA 2025 - 2026 Apply

The official 2025 - 2026 FAFSA application is available now, and can be used for fall 2025, spring 2026 and summer 2026 (7/1/25 - 6/30/26).

In future years, the application should be available on October 1.

What Does

FAFSA Stand For?

If you are new to apply for college, you probably are thinking, What does FAFSA stand for? FAFSA stands for Free Application for Federal Student Aid. It is a free form, from the Federal Student Aid office of the U.S. Department of Education. It is the federal student loan application, but it is more than that. FAFSA is your gateway to be considered for 9 different federal student aid programs such as Federal Pell Grants, over 600 different state aid programs, and most of the institutional aid programs at private and public colleges and universities in the U.S.

FAFSA is also required for consideration to receive financial aid for specific student populations such as athletes, students with dependents, and military and their dependents.

The U.S. Department of Education begins accepting the FAFSA applications beginning October 1 of each year for the next fall academic year. Most federal, state, and institutional aid are considered on the basis of first come, first served. Therefore, students should submit their FAFSA applications as early as possible to be considered for maximum financial assistance. If you file your FAFSA federal student loan application later, the grants for college students may be gone, and you may only be eligible for whichever student loan programs still have money. And if you submit your FAFSA too late, all the federal and state grants and loans may be gone, so you may need to take more expensive private student loans to finance your college education. For a list of FAFSA deadlines by state for state grants, see FAFSA Deadlines.

The FAFSA and the CSS Profile are the two most common applications you will use for college loan forms.

Steps to

Complete FAFSA Application Form

Step 1: Are You a Dependent or Independent Student?

Before you fill out the FAFSA, you'll want to know if you are a dependent or independent student. For the FAFSA questions to help you decide, see Are you Dependent or Independent Student for Federal Student Financial Aid ?

If you are a dependent student, you will need at least one parent's financial information on your FAFSA application. To see which parental information needs to be included, see Parental Information for FAFSA Applications.

Step 2: Social Security Number

You will need to have your social security number (the student’s social security number). If you are considered a dependent student, whether or not you live with your parents or legal guardians, or are claimed as a dependent on their tax forms, you will need your parents’ or legal guardians’ social security numbers too. If your parents or legal guardians do not have social security numbers, enter all zeros when asked for their number(s).

Also make sure that your name and its spelling is exactly the same way it appears on your social security card. Avoid using nicknames. If you have changed your name, you must update your records with the Social Security Administration.

Step 3: Obtain a FSA ID (FAFSA PIN)

You should apply for your FSA ID, as well as FSA ID for your parent who is providing financial information, if you are a dependent student. A FSA ID is recommended if you submit an online FAFSA application, but is not required if you choose to mail in a printable FAFSA application.

Step 4: Collect Financial and Tax Records

Collect your and your parents financial records if you had an income (from work, or veteran’s benefits, for example), or if you filed for federal tax return, as well as your parents’ federal tax return. These records include your W-2 forms, other records of income you have had, and your current bank statements for example. You will use your completed tax return from the prior year (e.g. 2023 tax return for the 2025-26 school year).

Be sure you know the deadline for financial aid in your state, as there are many state grants available for those who apply early. See FAFSA Deadline by State.

Also, since the amount of money in your bank account matters as of the date you submit the FAFSA, consider submitting when your account balance is low not high. For more information on this, see How to Reduce Your Expected Family Contribution.

Step 5: Gather Other Documentation

Have an email address and provide it to receive your FAFSA results faster.

Have Your Driver’s License Number (optional but recommended)

Have your Alien Registration Number (if applicable)

Step 6: Complete Paper FAFSA Draft

Print and fill out a Printable FAFSA Application as a draft. That way you can easily see all the information that is required, and check the instructions if you have questions.

As an alternative, there is a FAFSA worksheet that is a shorter version, but I think most people will make fewer errors if they fill out the entire paper FAFSA first as a draft.

Step 7: Complete Online FAFSA Application

Allow about an hour to complete the online FAFSA form. Remember that there are different sections for student, student spouse, parent, and parent spouse or partner. Note that the online FAFSA may ask some questions in different order, and may skip some questions based upon your answers. Make sure that you read the questions carefully and answer them correctly because any mistake can delay the processing of your application which translates into missing the deadlines or losing out on some federal, state or private financial aid.

Consent from all parties is required to allow the Federal Tax Information (FTI) tool to import tax information from your federal tax return.

The online FAFSA form can be found at the official FAFSA website at studentaid.gov.

Step 8: Check Status of FAFSA

After submitting your FAFSA application, you may check the status of FAFSA application, access your federal financial aid records, review your FAFSA Submission Summary and submit any missing documents.

FAFSA 2024 2025 Apply Student Loan Application Schedule

If you are applying for college in fall 2024 - spring 2025 (July 1, 2024- June 30, 2025), plan to submit the FAFSA, after you've submitted your college applications such as the Common App , so you will be prepared to submit your college loan forms applications (FAFSA and CSS Profile, if needed) as soon as possible.In most years, you can submit your FAFSA starting October 1 for the next year that you plan to start college, and you must reapply for each year. The earlier you apply the better, and most schools have early deadlines, with more flexibility for community colleges.

The official 2024 - 2025 FAFSA application was delayed until December 2023, but is now available and can be used for fall 2024, spring 2025 and summer 2025.

FAFSA 2025 2026 Apply Federal Student Loan Application Schedule

If you are applying for college in fall 2025 - spring 2026 (July 1, 2025 - June 30, 2026), plan to submit the FAFSA, after you've submitted your college applications such as the Common App , so you will be prepared to submit your college loan forms applications (FAFSA and CSS Profile, if needed) around December 1, 2024.

You can submit your FAFSA starting October 1 (delayed to late November in 2024) for the next year that you plan to start college, and you must reapply for each year. The earlier you apply the better, and most schools have early deadlines, with more flexibility for community colleges.

More FAFSA Help

Dependent or Independent Student

Welcome!

Welcome to College Financial Aid Advice, a website full of information on scholarships and grants, student loans, and other ways to save money at college.

Important Things to Do

Scholarships for 2025 - 2026 - It is never too early or too late to work on your scholarship searches. If you are part of the high school class of 2025, you should work on your scholarship and college search now. See our list of Scholarships for High School Seniors

FAFSA - The official 2025 - 2026 FAFSA is available now. FAFSA.

College Financial Aid Tips

Scholarship Lists An overview of the different types of Scholarship Money for College.

Grants Learn more about grants, the other free money for college.

Need Tuition Help? Reduce the cost of tuition with these college Tuition Assistance Programs.

Tax Credit Claim the American Opportunity Tax Credit.

College Savings Plans Save money for college with these College Savings Plans.

Need a Student Loan? Yes, you qualify for these college Student Loans.

Popular Scholarship Searches

Scholarships for High School Students